- #IS QUICKBOOKS FOR MAC COMPATIBLE WITH WINDOWS FOR MAC#

- #IS QUICKBOOKS FOR MAC COMPATIBLE WITH WINDOWS FULL#

- #IS QUICKBOOKS FOR MAC COMPATIBLE WITH WINDOWS SOFTWARE#

- #IS QUICKBOOKS FOR MAC COMPATIBLE WITH WINDOWS PC#

- #IS QUICKBOOKS FOR MAC COMPATIBLE WITH WINDOWS MAC#

Other nice touches include integrated time tracking so it can be used as a billing tool too, employee access so they can check pay stubs and automatic tax liability calculations.

#IS QUICKBOOKS FOR MAC COMPATIBLE WITH WINDOWS MAC#

The ability to execute payroll runs away from your Mac in particular is really useful if you can’t be in the office or at your desk for any reason. You also get the useful QuickBooks Payroll mobile app which gives you the power to run payrolls, pay taxes, file forms and view your employee’s salary history. However, we recommend subscribing to QuickBooks Payroll online as Intuit is slowly discontinuing the desktop versions of its products.

#IS QUICKBOOKS FOR MAC COMPATIBLE WITH WINDOWS SOFTWARE#

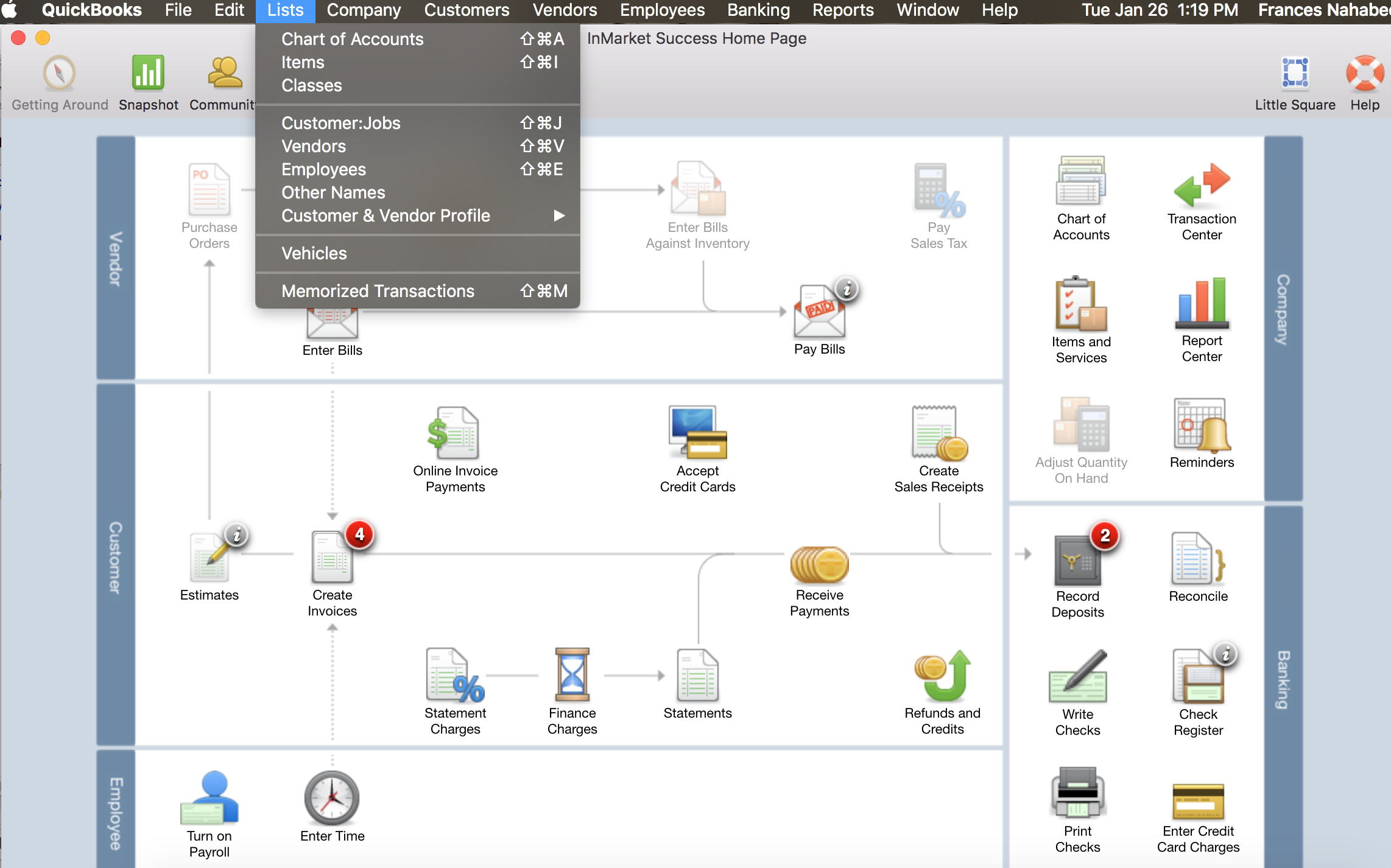

QuickBooks accounting software is one of the most widely used and respected in the industry, so much so that almost all the other payroll solutions featured here offer optional integration with it.Īlthough there’s no QuickBooks Payroll desktop app, it can be used via the QuickBooks Desktop Mac 2021 accounting software desktop as an added module if you subscribe to it. QuickBooks Payroll is the best payroll software on the market thanks to its incredible ease of use and integration with a wide range of accounting packages.

#IS QUICKBOOKS FOR MAC COMPATIBLE WITH WINDOWS FOR MAC#

With this in mind, here is the best payroll software for Mac and Windows PCs of 2021 in order of ranking.

#IS QUICKBOOKS FOR MAC COMPATIBLE WITH WINDOWS PC#

What To Look For In The Best Payroll Software

#IS QUICKBOOKS FOR MAC COMPATIBLE WITH WINDOWS FULL#

It’s much quicker – pay schedule templates and payroll runs can be executed instantly with payroll software.You’re less likely to make mistakes calculating state taxes using Payroll software.Doing payroll yourself is much cheaper than outsourcing.

The IRS calculates it fined businesses a massive $4 billion for mistakes with payroll accounting.Īdvantages to using your own in-house Payroll solution include: One of the biggest reasons for this is because payroll administration is notoriously complex due to ever changing payroll tax laws which make it very easy to get caught out.Īnd getting your payroll wrong can be extremely costly. Most tax filing software don’t deal with payrolls and even many of the best accounting software stay away from payroll completely. To do payrolls properly, you need dedicated software. Lightening (Best Australian Payroll Software) What To Look For In The Best Payroll Software.

0 kommentar(er)

0 kommentar(er)